Behavioral Finance - Heuristics And Biases Mini Course

Behavioral Finance - Heuristics And Biases Mini Course

Published 10/2025

Created by Bryan Foltice

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz, 2 Ch

Level: Intermediate | Genre: eLearning | Language: English | Duration: 17 Lectures ( 2h 24m) | Size: 3.1 GB

Why We Think the Way We Do — And How It Affects Our Money

What you'll learn

Understand the Role of Heuristics in Decision-Making

Recognize and Explain Common Cognitive Biases

Differentiate Between Type 1 and Type 2 Thinking

Apply Concepts of Heuristics and Biases to Real-World Financial Behavior

Requirements

Basic Understanding of Finance or Economics

Description

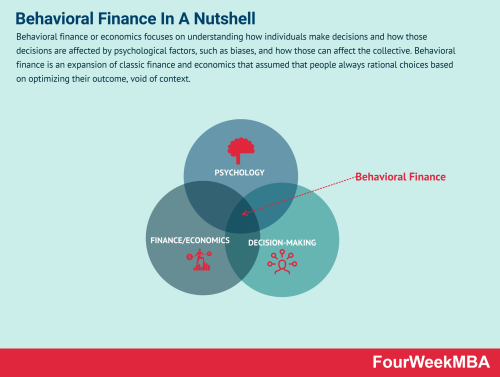

Why do intelligent people make poor financial decisions? Why do we hold onto losing investments, follow the crowd during market bubbles, or overlook better options simply because they're unfamiliar? This course unpacks the powerful—and often invisible—psychological forces that shape financial behavior. Blending behavioral economics, cognitive psychology, and real-world financial examples, students will explore how heuristics (mental shortcuts) and cognitive biases systematically influence the way we think, decide, and invest.The course introduces foundational concepts like Type 1 and Type 2 thinking, framing effects, and the limits of rational choice. From there, we dive deep into specific biases such as loss aversion, overconfidence, anchoring, availability, status quo bias, and the endowment effect. Students will examine how these biases affect individual choices (like saving, spending, and risk-taking), as well as broader market behaviors including herding, mispricing, and volatility.Through interactive lectures, video-based modules, and reflection exercises, students will learn to recognize their own cognitive blind spots and develop strategies to mitigate them. Whether you're a student of economics, finance, psychology, or simply interested in making better decisions, this course provides a valuable toolkit for navigating a world where logic and behavior often diverge.By the end of the course, students will be equipped to make more intentional financial choices and critically evaluate the decisions of others—whether investors, policy makers, or peers.

Who this course is for

Undergraduate or Graduate Students Studying Finance or Economics

Financial Professionals & Advisors

Individuals Curious About Their Own Money Behavior

Instructors and Educators

https://rapidgator.net/file/b9c3533b672f8c773fe11cf177fa8489/Behavioral_Finance_-_Heuristics_and_Biases_Mini_Course.part4.rar.html

https://rapidgator.net/file/c39ffc6a06a465eb52cea67040675c5f/Behavioral_Finance_-_Heuristics_and_Biases_Mini_Course.part3.rar.html

https://rapidgator.net/file/041e82d2b0c7b68076e5ac08c49167a8/Behavioral_Finance_-_Heuristics_and_Biases_Mini_Course.part2.rar.html

https://rapidgator.net/file/72f1e75c1e548ab87e9f33d53a36dcb0/Behavioral_Finance_-_Heuristics_and_Biases_Mini_Course.part1.rar.html

Information

Users of Guests are not allowed to comment this publication.