Strategic Credit Modeling And Advanced Financial Diagnostics

Strategic Credit Modeling And Advanced Financial Diagnostics

Published 8/2025

Created by Starweaver Team

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz, 2 Ch

Level: Intermediate | Genre: eLearning | Language: English | Duration: 41 Lectures ( 2h 44m ) | Size: 2.1 GB

Master Ratio Analysis, Cash Flow Evaluation, PD Estimation & Credit Risk Modeling for Financial Decisions

What you'll learn

Execute comprehensive ratio analysis for credit evaluation using industry-standard metrics

Perform advanced cash flow analysis to assess debt servicing capabilities

Calculate probability of default and expected loss using quantitative models

Apply structural and reduced-form credit risk models for investment decision-making

Requirements

Basic knowledge of financial statements (income statement, balance sheet, cash flow), spreadsheet proficiency (e.g., Excel or Google Sheets), and general understanding of corporate finance concepts is recommended. No programming or prior credit risk modeling experience is required.

Description

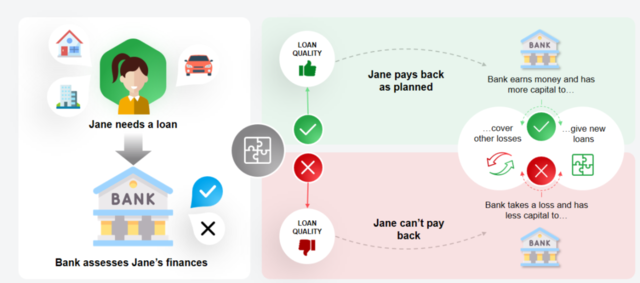

Understanding credit risk is essential for financial decision-makers, analysts, and investors. This course, Advanced Financial Analysis and Credit Risk Modeling, is designed to equip learners with the analytical tools and modeling techniques used by top-tier credit professionals, rating agencies, and investment firms.Throughout the course, you will develop practical skills in ratio analysis, cash flow forecasting, and quantitative modeling to assess an organization's creditworthiness. You'll start with a deep dive into financial ratios—including liquidity, leverage, and profitability—and learn how these indicators reveal critical insights into a company's ability to service debt. Next, you'll analyze cash flow statements using advanced techniques like EBITDA coverage, free cash flow modeling, and scenario analysis.The course then moves into the domain of quantitative credit risk modeling. You will learn how to estimate the probability of default (PD), calculate expected losses, and apply credit scoring techniques using Excel-based tools. Through interactive exercises, you'll gain hands-on experience in applying structural and reduced-form credit risk models for both sovereign and corporate credit evaluations.This course is ideal for finance professionals, credit analysts, and students preparing for roles in banking, investment, or risk management. By the end, you'll be equipped to make informed credit decisions based on robust financial and quantitative analysis.

Who this course is for

This course is for finance professionals, credit analysts, and advanced business students seeking to master credit risk modeling and financial analysis.

Buy Premium From My Links To Get Resumable Support and Max Speed

https://rapidgator.net/file/6cb6ce13b8304837de13f903704c89d8/Strategic_Credit_Modeling_and_Advanced_Financial_Diagnostics.part3.rar.html

https://rapidgator.net/file/ddab3087add3b1126c7ce8250d5c7a9b/Strategic_Credit_Modeling_and_Advanced_Financial_Diagnostics.part2.rar.html

https://rapidgator.net/file/cc0b35fba39bc9d2ae5546b33e33aed5/Strategic_Credit_Modeling_and_Advanced_Financial_Diagnostics.part1.rar.html

Information

Users of Guests are not allowed to comment this publication.